how to know how much unemployment tax refund will i get

Refund for unemployment tax break. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Enter an amount between 0 and 1000000.

. In the latest batch of refunds announced in November however the average was 1189. This is available under View Tax Records then click the Get Transcript button and choose the. Tax refund time frames will vary.

If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Check the status of your refund through an online tax account.

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. This is not the amount of the refund taxpayers will receive.

You reported unemployment benefits as income on your 2020 tax return. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. The state that paid your unemployment benefits should send you a Form 1099-G showing how much unemployment income you received and how much taxes it withheld.

You can also call the IRS however it can be difficult to get through. You will get an additional federal refund for the unemployment exclusion if all of the following are true. Heres a summary of what those refunds are about.

If youre married and filing jointly you can exclude up to 20400. This handy online tax refund calculator provides a. The full amount of your benefits should appear in box 1 of the form.

Unemployment tax refund status. At this point you should reach out to the IRS. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billionThats the same data the IRS released on November 1 when it announced that it had recently sent approximately 430000 refunds totaling more than 510 million. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. How much is the IRS unemployment Tax Refund.

You will need your social security number and the exact amount of the refund request as reported on your income tax return. Couples can waive tax on up to 20400 of benefits. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

Another way is to check your tax transcript if you have an online account with the IRS. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. In March 2021 the American Rescue Plan provided some relief for people who received unemployment benefits in 2020.

How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. Since may the irs has issued more than 87 million unemployment compensation tax. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

The second phase includes married couples who file a joint tax return according to the IRS. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. In March 2021 the American Rescue Plan provided some relief for people who received unemployment benefits in 2020.

According to the IRS the. If you recieved 10200 or more in unemployed subtract 10200 from your taxable income line 15. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962.

Know that these potentially sizeable refunds are thanks to President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on up to 10200 of unemployment benefits. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. You did not get the unemployment exclusion on the 2020 tax return that you filed.

The state that paid your unemployment benefits should send you a Form 1099-G showing how much unemployment income you received and how much taxes it withheld. If you recieved 10200 or more in unemployed subtract 10200 from your taxable income line 15. There is no way to know in advance when you will get your refund.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Check For the Latest Updates and Resources Throughout The Tax Season. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment.

The IRS will issue refunds in two phases. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by.

My unemployment actually went to my turbo card. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The total amount is 25000 but the couple would not be entitled to.

Follow these instructions to get to a live representative. The IRS gives the example of one spouse having received 5000 of benefits and the other getting 20000. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refund Timeline Here S When To Expect Yours

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Tax Refund Timeline Here S When To Expect Yours

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

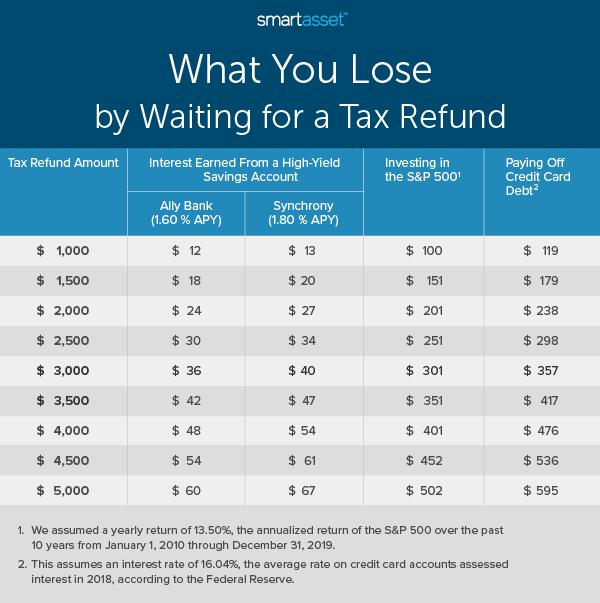

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Time Running Out For Ohioans Claiming 2017 Tax Refund

Ca Edd Update Pending Payments Pua Documents Meuc Unemployment Tax Refund Edd Login Error Code Tax Refund Edd Coding

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Tax Refund Irs The Motley Fool

More Than Half Of Americans Worried About Tax Refunds Fox Business

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Confused About Unemployment Tax Refund Question In Comments R Irs

Why Is Your Tax Refund Taking So Long Here Are Some Possibilities Cpa Practice Advisor